Meet HomeSights new board President Rebecca Bryant

When your father is an Antarctic explorer and both your parents are Smithsonian scientists, a strong sense of adventure and curiosity about the world might be genetic. Raised in a one-room cabin close to Red Rocks, Colorado, Rebecca Bryant shared her family’s sense of curiosity and adventure.

But law, not science, captured her Interest. Bryant said she wanted to work in Congress from a young age and first set her sights on a career in law. “I’ve always believed democracy can work well,” said Bryant. “I believe policy should help people no matter how they started in life.”

A political science major in college, Bryant’s internship at the USO in Washington, DC prepared her for a job on the staff of Washington state’s 9th District Rep. Adam Smith.

During her 10 years working for Smith, her boss was the top Democrat on the Armed Services Committee. Bryant says: “I was working with the Pentagon staff planning trips for my boss to Afghanistan, then supporting the committee staff in the ongoing priority of the Congressman’s to close Guantanamo.” Bryant compares her tenure working for Smith to the television show The West Wing. “I started as Charlie,” a young aide on the show, she said. “And ended as CJ,” the communications director.

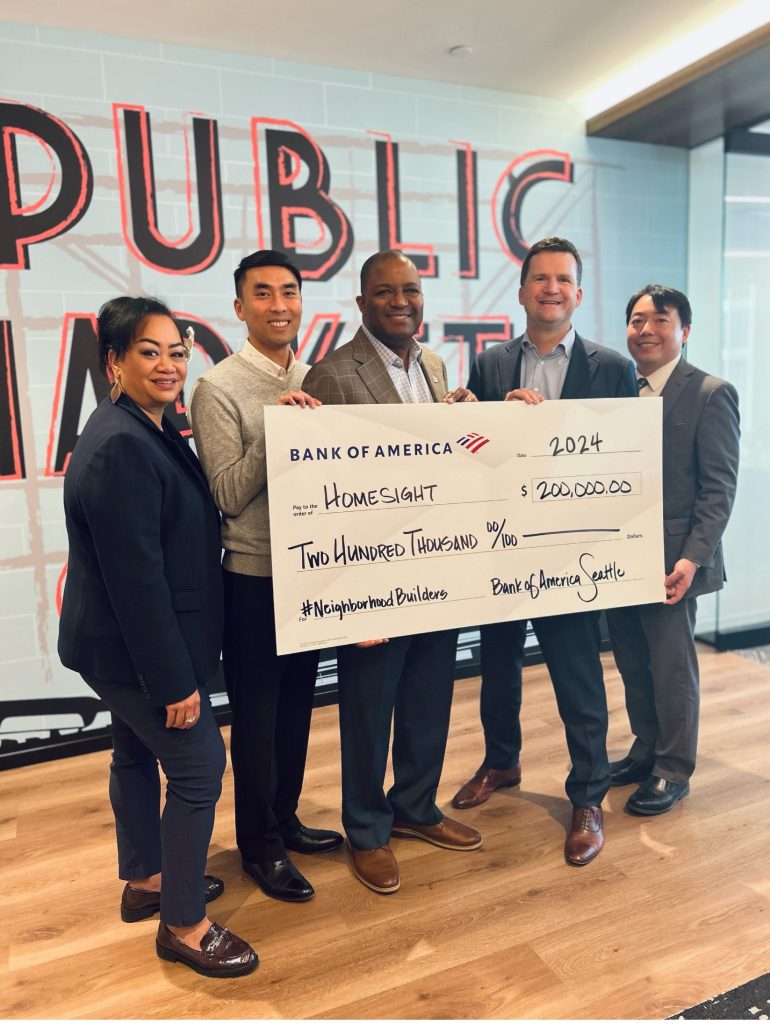

Bryant got to know HomeSight while running the Congressman’s reelection campaign from the 9th district office, the district where HomeSight is based. “I met [HomeSight founder] Tony To while planning the first Taste of the Ninth event, the now annual event Congressman Smith holds to celebrate the diverse communities of the 9th Congressional District,” Bryant recalled. After moving back to Washington, DC in 2014, Bryant was fortunate to see To when he visited the “other Washington” to advocate for affordable housing policy and funding and quickly reconnected with To and Homesight when she moved home to Seattle in 2019.

“I saw HomeSight doing such good work and embodying everything the 9th district is,” said Bryant. “Anytime I hear about someone buying a home, I picture each of those families. I believe everyone should have the opportunity to own their home no matter what circumstances they were born into. Not that long ago, Seattle had redlining. HomeSight is such a great example of undoing historical wrongs.”

Bryant is also involved in the community development side of HomeSight’s work. “That work is in my personal DNA, but I didn’t know as much about it until I joined the board,” Bryant said.

Bryant joined the board in 2020. She now works in government affairs at Fred Hutch but keeps in touch with her old colleagues in the 9thdistrict office, recently inviting them to join her for lunch during HomeSight’s Plate of Nations restaurant promotion event this spring.

“HomeSight is in a special place right now,” said Bryant. “We’re on the front lines of keeping people in homes, and making sure people have homes. Now, and over the next couple of years, this work matters more than ever.”