In summer 2020, as the nation reeled from the double blow of the pandemic and the civic unrest following the murder of George Floyd and others, two real estate agents at Windermere reached out to HomeSight. These agents didn’t know one another, but they were thinking the same thoughts at the same time.

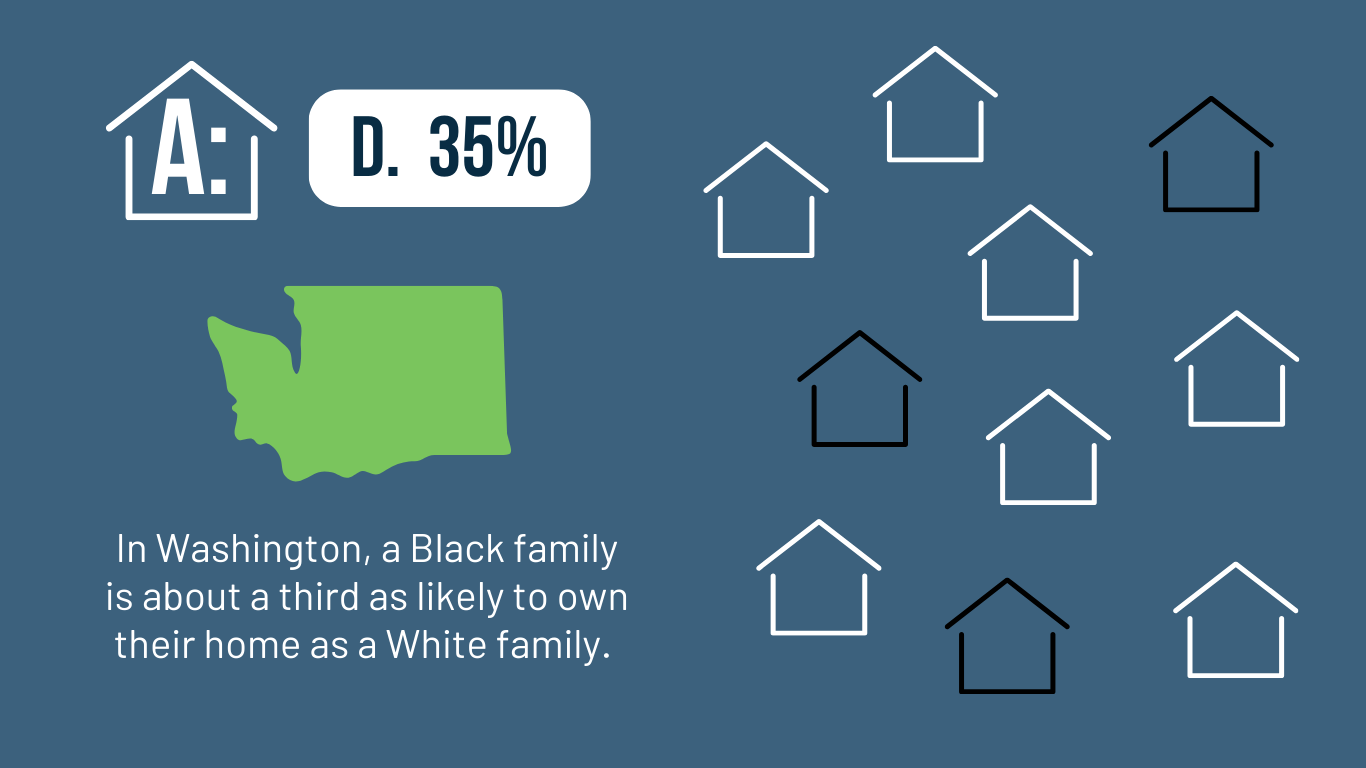

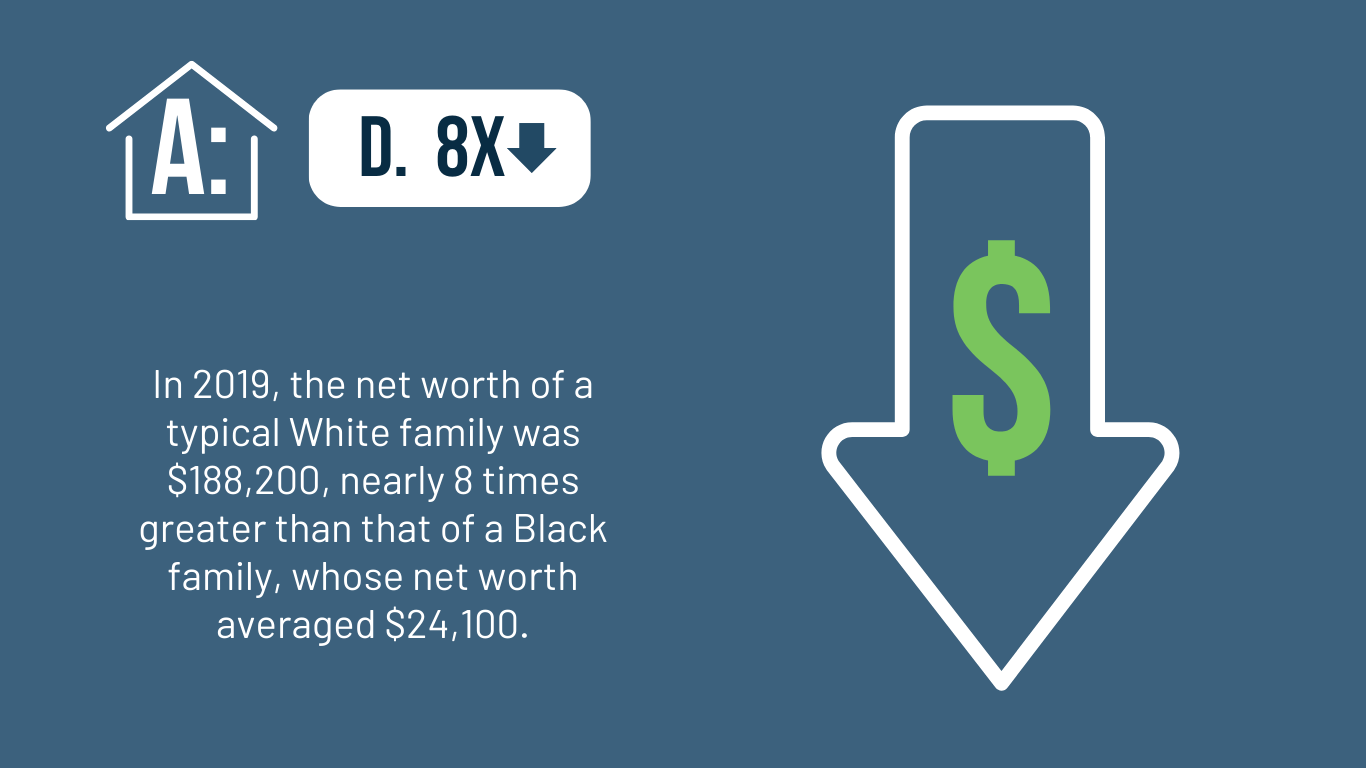

These agents had seen the toll racial inequality had taken in their field and wanted to make a difference for the Black community, whose ability to build wealth through homeownership was hampered by the generation-spanning legacy of slavery. Despite COVID’s impact on their own finances, they both reached out individually to HomeSight to ask how they could help Black families with their down payments.

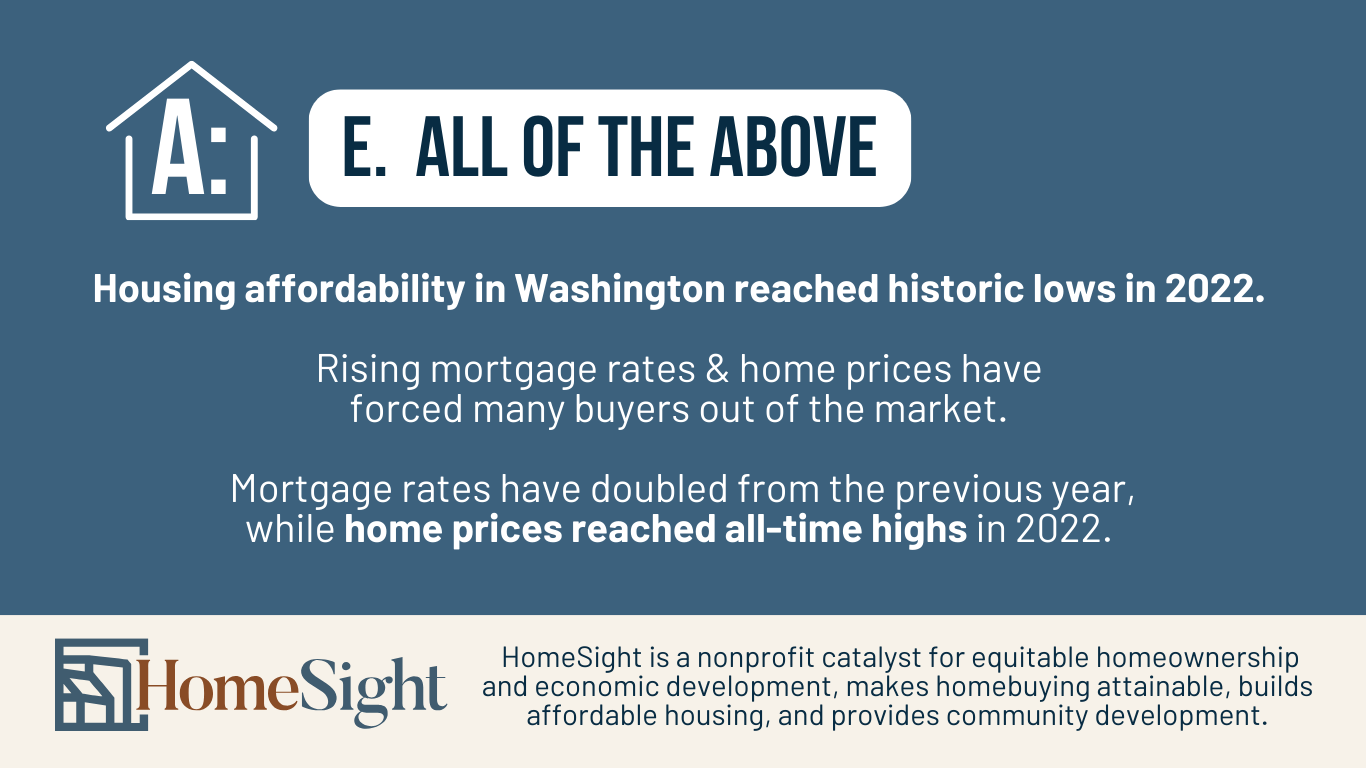

HomeSight was the right door to knock. Loan originators at HomeSight were witnessing the growth of a new type of housing crisis. Despite being eligible and able to afford a mortgage, moderate-income families who earned too much to qualify for assistance were increasingly unable to reach the down payment.

HomeSight lenders wanted to increase down-payment assistance to these families. A relatively small investment upfront could completely change the trajectory of a family, and a community, for generations to come.

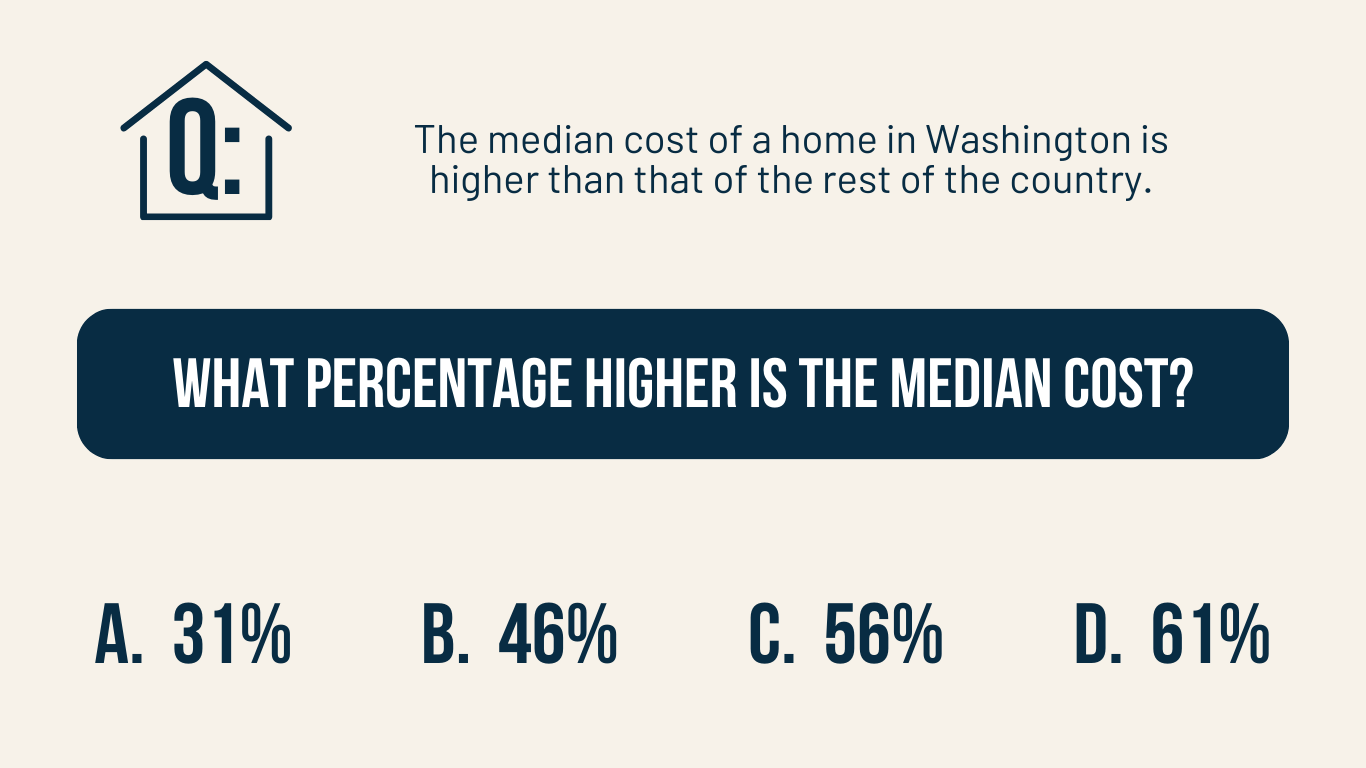

As a real estate agent, Paige Dumler had a front-row seat to the soaring cost of starter homes in Washington. She saw as prices soared increasingly out of reach for first-time homebuyers, especially for people of color. She’d seen racial disparity and inequity growing worse. And in the summer of 2020, just steps from her Capitol Hill home, she saw equity and racial injustice explode into the city’s, and the country’s, consciousness.

Dumler knew equity was a huge, complex, societal issue. She knew that, as one person, she couldn’t solve it, but she was, as she described herself: “the kind of person who asks: ‘What can I do to help?’” So she called HomeSight and asked if she could provide down payment assistance for a family of color, to help them reach homeownership.

Meanwhile, another Windermere agent, April Geneva, had started to develop and voice the same concerns. One of Geneva’s clients was selling her inherited house in the Central District – the client’s mother had purchased it in 1989 for $65,000 – and told Geneva: “My mom made an amazing investment, and I recognize that I am now benefiting from generational wealth. I’m sad, leaving the neighborhood, and knowing that not a lot of black folks in Seattle can afford to live here anymore.” The client asked Geneva point blank: “What are you, as realtors, doing about who has access to housing?” Geneva relayed the conversation to a colleague, and said she wanted more black families to experience the benefits of generational wealth.

After meeting with the agents, HomeSight reached out to other housing leaders to explore the creation of a tailored, down-payment assistance program for moderate-income borrowers. The Windermere agents approached Windermere’s president, OB Jacobi, who committed Windermere’s full support, acknowledging the industry’s history of discriminatory practices and its commitment to diversity, equity, and inclusion.

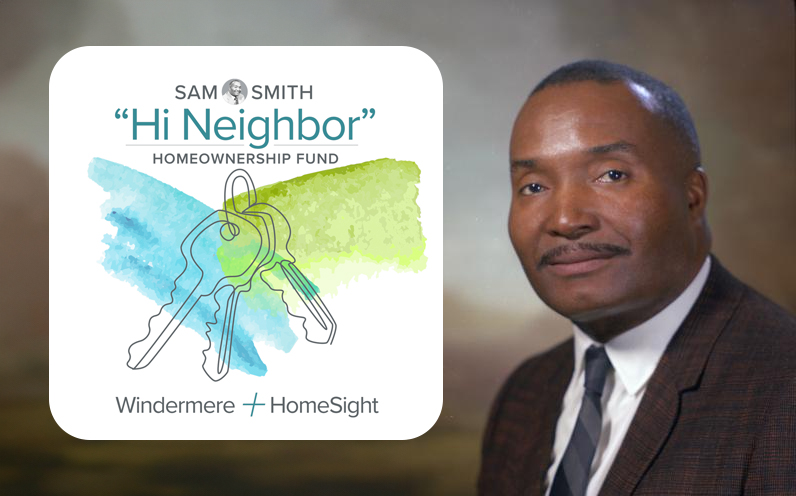

By mid-2021, the fund was created with a $40,000 contribution from Windermere and HomeSight’s match. Approved by Sam Smith’s family, the fund’s name pays tribute to a Seattle political icon who was key in enacting the Open Housing Law of 1967. The fund provides up to $20,000 in down-payment assistance to Black families earning between 80% and 120% of Washington’s median income.

Like many agents of change, the Sam Smith “Hi Neighbor” Homeownership Fund was the result of people working together to find solutions, and inspiring others to join.

The program has inspired more partnerships. At each closing, Windermere agents are asked to donate a portion of their commissions to the fund. These donations are then matched by the company’s non-profit arm, the Windermere Foundation. Seeing the success of the program, JP Morgan Chase, Zillow, and US Bank pledged their commitment to the cause. To date, the Sam Smith Fund has helped a dozen families reach homeownership.

“We’ve got to be willing to find different ways,” said Geneva. “This market is really, really difficult. We live in a city where housing is insanely expensive. I’m proud of the fact that the work has begun.”