Join a Cultural Exchange Tour

Join a Cultural Exchange Tour and Be a Tourist in Your Own Town

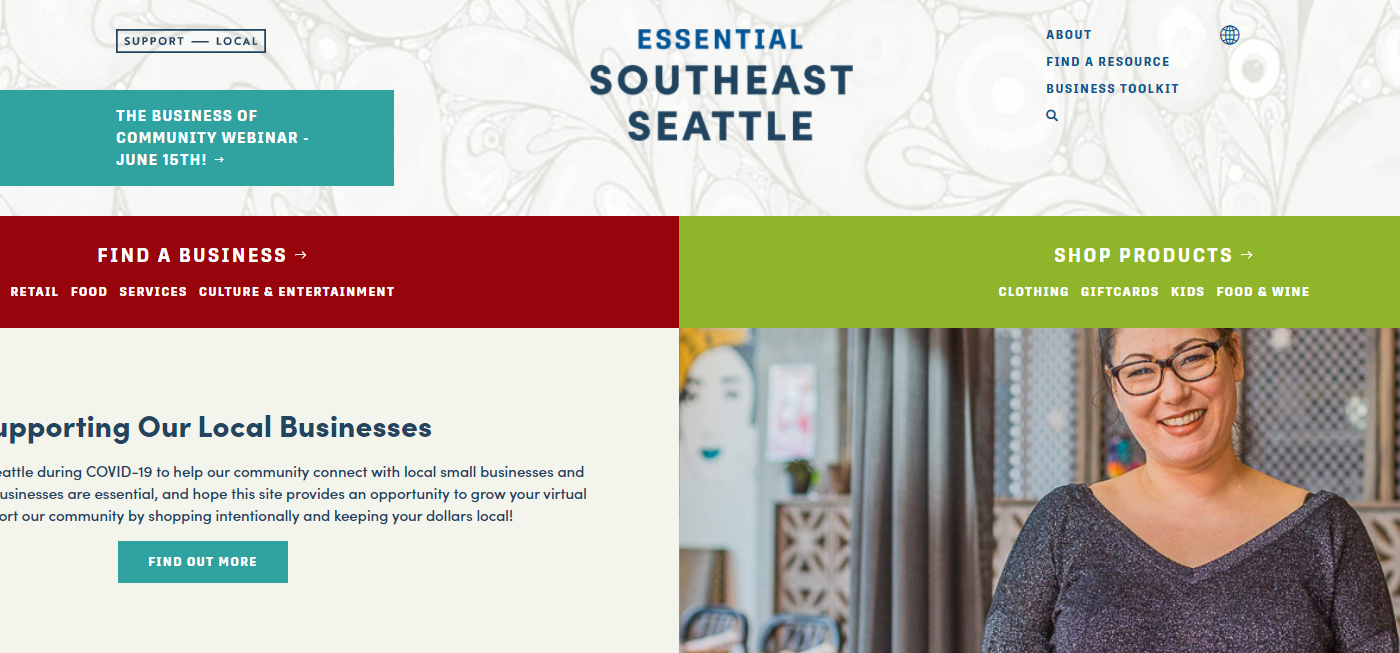

Leave the Space Needle to the out-of-towners. HomeSight’s “100% Recommended” Cultural Exchange Tours give city residents and visitors an inside look into Seattle’s most diverse communities.

Not all tours are just for tourists. For over a dozen years, HomeSight has been inviting curious neighbors, old and new residents and passers-through to join them for a Cultural Exchange Tour, an unforgettable deep-dive into the culturally diverse Othello and Graham neighborhoods.

These South Seattle neighborhoods aren’t the city’s typical tourist stomping grounds, but tourists and residents alike are delighted when they experience HomeSight’s showcase of the best and most diverse shopping and dining neighborhoods in town.

The tours, which are free but require registration in advance, are held four Saturdays this summer—the remaining three tours are July 15 th, August 15th and September 9th from 11 a.m.-12:30 p.m.

The tours are led by locals along a route designed to give participants an inside look into corners of the neighborhood they may not have explored. With prizes, free food and giveaways, the tour introduces the people of South Seattle as well as the places.

Said HomeSight Director of Community Development Sarah Valenta, “We don’t just want to show people where stuff is. We want to build a real community.”

The idea for the first Cultural Exchange Tour was hatched in 2008, when the city’s light rail project drove its development plans through the heart of Othello, purchasing properties, laying track and building stations. In response to the changes transforming their neighborhood, businesses organized and formed the MLK Business Association.

“We wanted to make sure the neighborhood had a voice among all these changes,” said Valenta. “We said: ‘we have something special here.’ We wanted to make sure the neighborhood’s small businesses weren’t getting displaced. One of our neighbors, Mona Lee, stood up and said: ‘I’m going to give people a tour.’ And it just took off from there.”

Now supported by a swell of community involvement, the tour has stayed true to its original purpose. “We wanted to prevent the retail leak that often comes along with neighborhood growth and gentrification,” said Valenta. “We want residents to know they can get all their necessities here: groceries, medicine and services. We even have a stop at a Buddhist temple this year. We want to keep our residents in Rainier Valley. The light rail is a great asset to the community but with it comes the real risk of displacement of our incredibly diverse demographic.”

Valenta said HomeSight has gotten “amazing feedback” from participants over the years. Surveying all participants, “we usually hear back that 100 percent of our participants would recommend the tour to someone they knew,” said Valenta. “I love hearing that, and I love hearing from people who commute through the neighborhood but have never stopped to take a look. I’ve heard from so many people: ‘I’ve never visited any of these businesses before and now I will definitely be back.”